Record fee cuts at Vanguard but not for popular S&P 500 fund

Published in Business News

Vanguard Group has cut fees on 87 of its 428 investment funds. The Malvern, Pennsylvania-based investment giant says the reductions will save some of the company’s more than 50 million stock and bond fund investors a total of more than $350 million this year, the most ever from its annual fee adjustments.

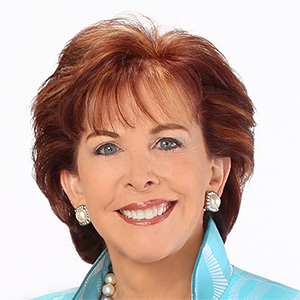

The cuts signal that Vanguard CEO Salim Ramji, who was appointed last year and was the first outsider in the top job since the company’s 1975 founding, is “continuing the tradition of lowering costs,” said veteran Vanguard-watcher Jeff DeMaso, publisher of the Independent Adviser for Vanguard Investors newsletter. “It’s a nice win for investors.”

In a statement, Ramji cited the legacy of founder John Bogle, noting that “lower costs enable investors to keep more of their returns,” a savings that compounds over time for long-term retirement investors.

The cuts included some of Vanguard’s largest bond funds but also some of its U.S. and foreign stock funds, and money-market funds. Vanguard expects bond yields will be higher for the foreseeable future.

This year Vanguard announced no fee increases unlike in some prior years.

Here are some examples of the cuts:

—Vanguard’s Total Bond Market Index Fund cut fees for most investors, to 0.04% of assets, from 0.05% last year.

—Vanguard’s Treasury Money Market Fund, cut to 0.07%, from 0.09%.

—PrimeCap Core stock fund, to 0.43%, from 0.46%.

—The company’s Consumer Discretionary, Consumer Staples, Energy Financials, Health Care, and other sector-based index funds and ETFs, to .09%, from 0.1%.

—Several classes of Russell small-cap and S&P category funds, to 0.07%, from 0.1%.

Vanguard’s most popular fund, the Vanguard S&P 500 Index fund, which accounts for almost one-sixth of Vanguard’s $10 trillion in assets, did not post a rate cut, despite accounting for roughly half Vanguard’s $220 billion in new investments. That fund, like its rivals at Schwab, Fidelity, and BlackRock’s iShares ETFs, which Ramji formerly ran, already offers “very, very low fees,” DeMaso said.

DeMaso in an email exchange questioned whether Vanguard would have been better off trimming fees less and using the money to provide better service for some customers.

While Vanguard continues to offer “solid funds at lower costs — this is the Vanguard we all fell in love with,” De Maso said. Vanguard’s brokerage service, where the company has obliged most individual customers to move their investments by raising account fees, “continues to disappoint investors,” DeMaso add, citing complaints. “Lower fees are good for fund shareholders but create pressure on the brokerage platform.”

Lower fees have helped Vanguard post higher investor returns and to grow, Greg Davis, Vanguard’s president and chief investment officer, said in a statement. Vanguard has gained market share even as competitors shrank in years stock values fell.

The company’s clients now own 8% to 9% of U.S. stocks, and Vanguard has agreed to limit its use of its potential shareholder influence over energy and financial companies, after energy-state governors, FDIC leaders, and other public officials expressed concern.

Asked if Vanguard was pricing to beat competitors rather than reflecting economies of scale at individual funds, spokesperson Jeremy Eisengrein said “there are a number of factors we consider” in addition to changes in fund assets, such as expenses and manager costs.

Unlike rivals that are typically shareholder-owned public companies like BlackRock, or family-owned firms like Fidelity, Vanguard is a private, for-profit firm, owned by its shareholder funds and controlled by an effectively self-perpetuating board of directors.

Ramji is the first Vanguard CEO who does not also serve as board chairman. Board director Mark Loughridge, retired chief financial officer of IBM, moved into that post last year.

©2025 The Philadelphia Inquirer, LLC. Visit at inquirer.com. Distributed by Tribune Content Agency, LLC.

Comments