Missouri Republicans seek to roll back voter-approved minimum wage increases

Published in Business News

JEFFERSON CITY, Missouri — Missouri House Republicans are looking to alter the new minimum wage and sick leave law voters approved in November.

Proposition A, which passed in rural, suburban and urban parts of the state, raised the minimum wage from $12.30 an hour to $13.75 an hour this year. It will go up again to $15 an hour in 2026, with inflationary increases allowed after that.

Employers with gross annual receipts of at least $500,000 will also be required to provide earned sick leave to employees.

While some proposed legislation would throw out the measure altogether, the bills that are gaining traction only do away with parts of what voters approved.

The chairman of the House Commerce Committee, which is considering plans to change the new law, spoke positively of such efforts on Wednesday.

Rep. David Casteel, R-High Ridge, said in an interview he is in favor of eventually moving the minimum wage to $15 an hour, but thinks the increase comes too soon under the current law.

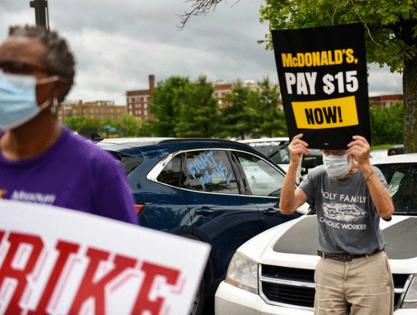

$15 minimum wage

A supporter for a ballot question to raise the minimum wage carries a box of signatures into the Missouri secretary of state’s office on Wednesday, May 1, 2024.

He also said that Legislature needs to look into whether more businesses should be exempt from the sick leave requirements. House Speaker Jon Patterson, R-Lee’s Summit, echoed the sick leave concerns at a news conference last week.

The House Commerce Committee considered two minimum wage bills on Wednesday.

The first, filed by Rep Carolyn Caton, R-Blue Springs, would strip out annual Consumer Price Index adjustments and exempts people younger than 20 from the minimum wage increase.

The bill also allows businesses with up to $10 million in annual gross revenue to not provide sick leave.

The second, by Rep. Scott Miller, R-St. Charles, would exempt workers under 21 from the minimum wage increase.

His bill also would allow employers to garnish wages if an employee doesn’t submit two-weeks notice or violates an area of company policy.

During the hearing, Buddy Lahl, CEO of the Missouri Restaurant Association, asked that businesses with fewer than 100 employees be exempt.

He also argued that exempting those under 20 or 21 would give businesses an opportunity to have employees on a “training wage.”

“If you apply these rules to businesses of 100 (employees) you’re really cutting out a huge swath of the population who work in small businesses,” Rep. Pattie Mansur, D-Kansas City, said in response.

One of the bills considered last week in committee, filed by Rep. Jeff Vernetti, R-Camdenton, would exempt businesses with 50 or fewer employees from the wage increase and sick leave provisions.

Seasonal businesses that are in operation for less than half the year are also exempt from those provisions under Vernetti’s proposal.

Almost half of all private sector employees in Missouri work in a business with less than 50 employees, according to data from the Missouri Economic Research and Innovation Center.

“We want to make this a more welcoming state for businesses to open, and I think laws like this really deter people from starting things or taking things on,” Vernetti previously said.

Missouri’s minimum wage has been steadily increasing since 2006 as voters have repeatedly passed ballot measures to increase it.

The 2006 ballot measure raised the minimum wage an average of 3.5% annually until 2019 following another ballot measure to raise the minimum wage.

The 2018 proposition rose wages an average of 6.2% annually. Voters again approved an increase in 2024.

In addition to the legislative pushback, Republican-leaning groups such as the Missouri Chamber of Commerce and Industry in December filed a petition with the Missouri Supreme Court to undo Proposition A.

The case will be argued before the Missouri Supreme Court on March 12.

The House bills are 958, 758 and 546.

©2025 STLtoday.com. Distributed by Tribune Content Agency, LLC.

Comments