Jill On Money: Market reaction to Trump 2.0

The election is behind us and the immediate investor reaction to Trump 2.0 was overwhelmingly positive. On the day after the election, the S&P 500 was up 2.5 percent, the Dow Jones Industrial Average was up 3.6%, the NASDAQ Composite gained 2.95%, and the Russell 2000 index of small company stocks surged 5.8%.

The quick take is that a Trump administration, working with a Republican Congress, should be able to enact policies that will foster a new burst of economic growth.

There are two Trump policies that could stimulate the economy: low taxes and an easing of regulations in industries like energy, banking and crypto. On the tax front, the individual tax cuts that were enacted under the Trump Administration’s Tax Cut and Jobs Act (TCJA) of December 2017, were set to sunset — or go back to where they were before the legislation went into effect, at the end of 2025.

During the campaign, the president-elect said that he would prioritize extending those tax cuts and would also like to add more tax relief in the form of excluding certain types of income from taxation, like Social Security benefits, overtime pay and tips. (The TCJA slashed the top tax rate on corporations from 35 to 21%, but these cuts were a permanent feature of the law.)

Extending the TCJA tax cuts would add to the nation’s debt, an issue that may be part of the reason that bond investors seemed to be less thrilled with the outcome of the election. On the day after the result was in, bond prices tanked and yields jumped, partially because of the deficit issue and also due to another pillar of Trump’s campaign: to impose across the board tariffs on imported products.

Tariffs are fees that are slapped on imports, but foreign nations do not pay; rather U.S. importers, like car manufacturers, equipment makers, and construction firms, have to pony up.

These companies then have to make the decision of whether they would swallow the extra cost or pass it on to consumers. This chain of events is why economists call tariffs a sales tax on consumers. (It’s also why the small stock index, which is comprised of many domestic producers, led the charge higher after the election.)

Potential new tariffs could complicate the Federal Reserve’s upcoming decisions, just as the nation’s inflation rate is heading towards the central bank’s target. The Fed concluded a pre-scheduled policy meeting two days after the election and cut short term rates by a quarter of a percentage point to a range of 4.50 - 4.75%. In the statement, officials said growth is solid, the labor market is easing and there has been progress on inflation, though it still remains higher than the Fed’s target.

In the press conference that followed the decision, Chair Powell deftly avoided answering questions about the impact that potential Trump policies could have on monetary policy. But to state the obvious, if inflation starts to bubble up next year, interest rates could remain higher than currently anticipated.

There was a wonderfully candid moment in the presser that brought economic nerd-dom speculation to an end. The back story is that as president Trump elevated Powell to lead the Fed in early 2018, but subsequently trash-talked him for keeping interest rates too high.

During the campaign, Trump continued the criticism, though he softened a bit recently. All of this led one reporter to ask Powell whether he would resign as Fed Chair early (his term ends in May 2026). In what instantly became a mic-drop moment, Powell looked up from the reporter, into the camera, and quickly answered, “No.”

_____

_____

========

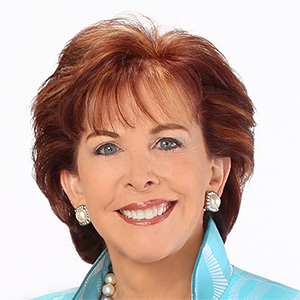

(Jill Schlesinger, CFP, is a CBS News business analyst. A former options trader and CIO of an investment advisory firm, she welcomes comments and questions at askjill@jillonmoney.com. Check her website at www.jillonmoney.com)

©2024 Tribune Content Agency, LLC

Comments