Is your home your piggy bank?

Despite the soaring value of the stock market, residential homes are considered the largest asset class in the country. The United States’ residential real estate market is worth $43.5 trillion, which is larger than the market capitalization of the S&P 500 stock index and the total value of all U.S. public companies.

The housing market accounts for 28.5% of household net worth. That’s why there’s such public interest in housing affordability and accessibility.

But what happens when it comes time to sell your home, or use your equity as a source of cash? It’s important to know the tax rules on sales of personal residences and the important steps you should be taking to comply with those laws, starting with the day you purchase your home and continuing as long as you own it.

Since you may own your home for 25 years or more, keeping records is essential.

The most significant tax rule on personal homes is the exclusion of $250,000 of gains for an individual (or $500,000 on a joint return), when the house is sold — but only if it has been your personal residence for the two of the five most recent years. Gain amounts above those exemptions are taxed at capital gains tax rates (which depend on your other income).

The definition of “personal residence” is critical. If you move to a sunshine state but rent the house to your children though still owning it, you cannot count that time as part of the two-year rule. This is not a one-time exemption, but you cannot use the exemption more than once in any two-year period.

The gains are calculated from the total cost of your house. That starts with the purchase price (including commissions) and goes on to include the value of all improvements you make to the property. The new roof you put on immediately after buying is considered part of the cost when you sell the home years later. And if you remodeled the bathroom or kitchen, you should keep track of all those bills from years ago. The new furnace, or hot water heater or gutters or window replacements should all be documented as improvements. Permanent landscaping is an improvement, but not the weekly lawn-mowing costs.

The bottom line is that if you throw away that old paperwork you will be unable to prove the expenditures! Keep a separate filing box over the years for housing improvements.

The step-up basis rule is more of an estate-planning rule than a home-sale rule. But I regularly hear from seniors who want to sell their family home to their children, hoping to avoid some estate distribution problems. Think twice. If you die with the home still in your name (or the name of your revocable living trust), there is NO capital gains tax, even on a large gain. Instead, the value of the home as inherited is its value on the date of death. If the heirs sell it immediately, there is no tax due. (Check with your accountant and estate planning attorney to see the impact in your own situation.)

Many seniors need cash but want to remain in their homes. They have two choices — both of them expensive, unless amortized over at least a decade. The first choice is a reverse mortgage, which will give you a lump sum of cash or a monthly withdrawal from your home equity. But there are fees associated with this deal, as well as interest to be paid, although the loan itself is not repaid until you sell the home, move out or die. But you must continue paying property taxes, insurance and upkeep. So, if money is tight already, a reverse mortgage might not be the solution. Learn more at ReverseMortgage.org.

A second choice is a home equity loan or line of credit (HELOC). The first gives you a lump sum, and the second works like a credit card, which you can use as needed to draw down your home equity. Again, there are fees involved, as well as interest, and — unlike RMs — loan repayments must be made. The lender will be interested in your source of monthly income to repay these loans. Check rates at Bankrate.com.

Your home may have been a wonderful piggy bank over the years. Just make your withdrawals carefully and don’t smash those savings in your attempt to get at the cash. That’s the Savage Truth.

========

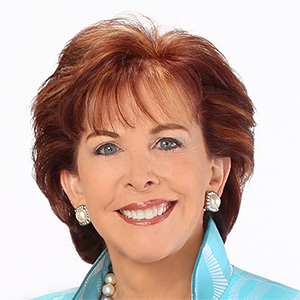

(Terry Savage is a registered investment adviser and the author of four best-selling books, including “The Savage Truth on Money.” Terry responds to questions on her blog at TerrySavage.com.)

©2024 Terry Savage. Distributed by Tribune Content Agency, LLC.

Comments