In these times of uncertainty, where is your 'chicken money'?

The stock market seems to be taking uncertainty in stride, as I write this column. Neither economic concerns over the impact of tariffs nor the political concerns revolving around the rule of law have so far dented enthusiasm for American stocks.

It’s been a long time since we’ve seen a bear market, and this column is not in the business of predicting future market direction. But it is important — especially if you’re nearing or in retirement — to have some money set aside in safe, short-term, liquid investments.

That’s what I call “chicken money.” It’s defined as money you can’t afford to lose. You won’t get rich with chicken money, and you may miss out on some stock market gains. But you won’t get poor, either.

In fact, the mantra of the chicken money investor is: I’m not as concerned about the return ON my money as I am about the return OF my money!

Chicken money belongs in FDIC-insured banks, in money market deposit accounts or CDs with maturities of less than two years. And as I’ve often recommended, Treasury bills are a perfect chicken money investment — IOUs directly from the United States government. You can find a feature article on the subject on the homepage at TerrySavage.com, “How to Buy Treasury Bills.”

In recent days, I’ve been hearing concerns about the security of chicken money investments because of news reports coming out of Washington.

There have been stories about a plan to end FDIC insurance, amid a reshuffling of bank regulatory agencies. There have been stories about unauthorized and unprofessional people getting access to the U.S. Treasury payments systems.

While these fears seem far-fetched, it’s certainly enough to keep savers awake at night. That’s discouraging because the entire idea of having some money set aside safely, is to allow you to sleep well.

So let’s put those concerns in perspective.

The entire United States financial system is based on confidence. The dollar is the benchmark of global trade and international finance. The potential consequences of a loss of faith in the dollar are immense.

First, the United States has a $36 trillion national debt. We borrow that money globally, by selling IOUs — Treasury bills (maturities up to two years), Treasury notes (from two to 10 years) and Treasury bonds (longer-term borrowings).

Every year a good portion of that debt matures, and must be “rolled over.” That means the Treasury must find new buyers of its debt — global central banks, pension funds, institutions, and even individual investors who open TreasuryDirect accounts to buy T-bills (minimum purchase $100).

If confidence is lost in the future value of the dollar, or the future of the United States’ economy, global bond buyers will demand a higher rate of interest.

This year, around $9 trillion of existing debt will mature and must be be refinanced — in addition to any new deficit financing the Congress decides to incur. In fact, this year the Congressional Budget Office is predicting a deficit of about $2 trillion. That’s a lot of money to borrow in one year!

Rising short-term interest rates add to the cost of borrowing. The Fed has made several rate cuts last fall — but six-month Treasury bills still yield around 4.3%. Longer-term 10-year bonds (on which mortgage rates are based) have actually risen a full percentage point since the Fed started cutting short rates. The 10-year Treasury currently yields around 4.5%.

Even more concerning, much of the Federal debt that is maturing and being refinanced carried significantly lower rates when it was issued a few years ago — less than 3% on average. Increased interest will increase our debt — just like it does on your credit card balances.

Think about this: Interest on the national debt now adds up to more than all non-defense discretionary spending combined!

That’s why it’s important to attack the deficit in an organized and sensible way — without creating uncertainty and concern among those who continue to lend us money at reasonable interest rates.

As of April 2024, foreign countries own approximately $7.9 trillion in Treasurys — or 22.9% of total U.S. debt. That’s down significantly from nearly one-third of our debt in recent years. Meanwhile, the central banks of China, India, Poland, and Turkey have increased their purchases of gold — diversifying out of dollars. Still, the U.S. dollar remains at high levels compared to other global currencies.

Americans live, spend, invest and plan our future in dollar terms. So, you should keep your chicken money in those short-term insured deposits and T-bills. If the credibility of the United States financial system is called into question, you’ll have more to worry about than your savings in chicken money. And that’s The Savage Truth.

========

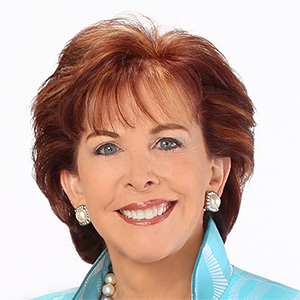

(Terry Savage is a registered investment adviser and the author of four best-selling books, including “The Savage Truth on Money.” Terry responds to questions on her blog at TerrySavage.com.)

©2025 Terry Savage. Distributed by Tribune Content Agency, LLC.

Comments