The Upside, Risks and Limits of DOGE

America's debt crisis is no longer a distant concern; it's an immediate threat with immediate consequences. Some politicians -- perhaps realizing that it's become more difficult to ignore the problem and avoid repercussions -- are turning to executive action. This includes the Trump administration's embrace of Elon Musk's increasingly active Department of Government Efficiency.

It's an unorthodox approach that may make some important progress reducing fraud and improving efficiency. But it isn't foolproof or without tremendous risks.

Federal debt stands at approximately 100% of GDP, with annual deficits projected to exceed $1.8 trillion and heading to $2.5 trillion in 2035. Interest costs on the debt are higher than defense spending and growing. Left unchecked, the debt could be nearly double the size of the economy by mid-century. That's also based on rosy assumptions like a growing economy and relatively lower inflation and interest rates.

Facing this foreseeable challenge, most politicians' responses have been inadequate. Some argue for raising taxes, but history shows that under this current tax code, it's practically impossible to raise revenue as a share of GDP consistently above 20%. That's in part because higher taxes slow growth and new revenues often trigger higher spending.

Others propose cutting discretionary spending, but these programs account for only one-third of the federal budget, making even the most aggressive cuts politically unacceptable without making much dent in our debt.

The primary problem is entitlement spending and interest payments on the debt. Social Security, Medicare and Medicaid already make up most federal expenditures and drive nearly all projected future deficits. Without serious reform, these programs will become financially unsustainable, forcing abrupt benefit cuts, massive tax increases or a mix of both.

Into this environment steps DOGE. The idea is simple: Have the executive branch impose small, incremental spending cuts across various agencies, bypassing the need for congressional approval. Here are a few things to keep in mind.

First, despite the usual alarmism by the usual people about how any spending cuts will have dramatic effect, many DOGE-style cuts are likely worthwhile. It's just that the savings are modest compared to the scale of our problems.

It's crazy that until now, no one has made such an attempt to end improper payments, fraud and redundant programs. But even if DOGE eliminates all improper payments and fraud -- an estimated $236 billion and $500 billion per year respectively -- we'll be facing a debt explosion. Social Security and Medicare are projected to require us to borrow $124 trillion over 30 years -- four times what we've borrowed in our entire history. It's not a case against DOGE cuts, but there's no substitute for structural reforms.

Second, cuts made without congressional approval might not last.

Leaving aside the legal challenges that will inevitably come from DOGE's actions, executive orders by nature are temporary. Future administrations can easily reverse its reforms with the stroke of a pen. That makes DOGE an unreliable long-term fiscal strategy.

Take the current push to reduce federal employment. Even if it holds up in court, if Congress doesn't reduce the scope of federal activities, the government may have to employ contractors to do the same jobs, or the next administration may rehire everyone. Fiscally, we may not be better off and could even be worse off.

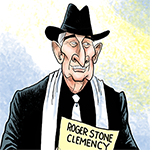

Perhaps the biggest risk is that DOGE is letting Congress off the hook.

By pretending that DOGE will solve our fiscal challenges, legislators would once again be failing to do their own jobs as stewards of our tax dollars. And if there's too strong a backlash against DOGE and its particular brand of spending reductions, it could set the cause of genuine reform back for decades.

This is not to question the executive branch's role in fiscal reform. The president should use his position to lead the conversation on debt reduction, propose spending restraint and veto irresponsible budgets. But Congress still has the power of the purse, and the longer legislators avoid making tough choices, the worse the crisis will become. We need our legislators to circumvent more drastic and painful adjustments in the future.

History proves this point. When Social Security faced insolvency in the 1980s, then-President Ronald Reagan and then-House Speaker Tip O'Neill worked together on a bipartisan deal. That compromise extended Social Security's solvency for decades. We need similar presidential-congressional leadership today.

No amount of discretionary cuts or anti-waste initiatives, no matter how worthy they are, will solve our long-term debt crisis. Ultimately, lasting reform must be legislated. President Donald Trump and Musk deserve credit for highlighting the debt crisis and taking action, but pretending that the job ends with them would be dangerous.

Veronique de Rugy is the George Gibbs Chair in Political Economy and a senior research fellow at the Mercatus Center at George Mason University. To find out more about Veronique de Rugy and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate webpage at www.creators.com.

----

Copyright 2025 Creators Syndicate, Inc.

Comments