Erin Lowry: Pay close attention to your credit card balance under Trump 2.0

Published in Op Eds

During Donald Trump’s reelection campaign, he boasted of plans to overhaul the federal government, promising to gut or even eliminate entire federal departments. One federal agency clearly in danger of being defanged is the Consumer Financial Protection Bureau.

Established in the wake of the financial crisis to protect Americans against abusive practices by banks and other companies, the agency under President Joe Biden has put in place much-needed checks against financial companies’ most egregious practices and has another batch of rules in the works. But if Trump 2.0 behaves anything like his first term in the White House, consumers should expect to play defense against financial institutions with little to no backup from the government.

Major areas where consumers could soon lose out include fighting excessive fees and rates charged by financial-services companies as well as oversight of shady debt collections and improper medical billing practices.

Under Biden, the CFPB called for medical debt to be removed from consumer credit reports and sought to rein in double and improper medical billing. The agency also has proposed setting limits on credit card late fees. Neither set of changes has gone into effect, and they are unlikely to be implemented before Trump takes office. And judging by Trump’s first term, when the CFPB stalled previously proposed consumer protection initiatives and watered down other regulations, it is hard to imagine the new administration advancing these measures.

The proposed changes were among the most meaningful consumer protections to emerge during Biden’s presidency. If adopted, they could lift credit scores for millions of Americans. Solid scores are vital to people’s financial well-being, paving the way to obtaining a mortgage, buying a car, renting a home and accessing other consumer services.

The proposal to cap credit card late fees at $8, a significant decrease from the current punishing highs of $30 for a first offense and $41 for a second one, could save U.S. consumers an estimated $10 billion annually. It was set to go into effect this year but was blocked by an injunction from a federal judge in Texas. Notably, the judge was a Trump appointee.

Led by the current CFPB chief, Rohit Chopra, the agency implemented sensible restrictions on buy now, pay later services, including giving consumers protections when disputing charges and suggesting that BNPL data be reported to credit bureaus. But much more needs to be done in this area to prevent vulnerable consumers from being taken advantage of. A good place to start would be to raise the age minimum and income requirements to take out buy now, pay later loans, bringing the rules in alignment with the requirements for credit cards.

Sadly, the CFPB, in whatever form it survives in the next administration, probably won’t be a strong advocate for those moves.

As regulators retreat, U.S. consumers will need to be vigilant in their banking practices. That includes reading the fine print of credit card agreements to understand that the cost of a missed payment might not only be a fee, but could be a sharply higher interest rate applied to the remaining balance. It means being diligent about paying at least the minimum owed by the due date to avoid incurring a costly late fee.

It’s hard to imagine that Chopra, whose term ends in 2026, will remain at his post once Trump takes office. The law creating the CFPB sought to protect the agency’s independence and insulate the director’s role from changes in administrations. But the Trump administration brought a challenge to the law, and the Supreme Court ultimately gave the president the power to fire the CFPB director.

(In a glimmer of hope for the agency’s future, the Supreme Court in a separate case upheld the mechanism that funds the CFPB, rejecting a challenge from the payday lending industry.)

It’s possible the Trump administration will surprise us and at least push forward with the credit card fee rules, since regulators have already come so close to the end of that process. Putting billions of dollars back into the pockets of the public would certainly help people struggling with the cost of living.

Americans dissatisfied with their economic circumstances propelled Trump to victory this month. Perhaps the incoming president will seize the momentum and actually do something on their behalf.

____

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

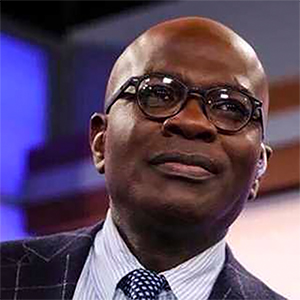

Erin Lowry is a Bloomberg Opinion columnist covering personal finance. She is the author of the three-part “Broke Millennial” series.

©2024 Bloomberg L.P. Visit bloomberg.com/opinion. Distributed by Tribune Content Agency, LLC.

Comments