Rocket Companies is buying Redfin, the real estate listing firm

Published in Business News

DETROIT — Rocket Companies said Monday it is buying the real estate listing platform Redfin in a deal valued at $1.75 billion.

The all-stock deal, expected to close in within about six months, would incorporate one of the country's largest mortgage lenders in Rocket with one of the top home search platforms in Redfin.

Seattle-based Redfin, founded in 2004, has more than 1 million for-sale and rental listings that garner almost 50 million monthly visitors, as well as a brokerage of more than 2,200 agents.

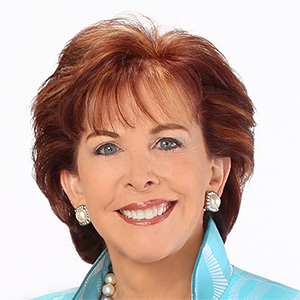

“Rocket and Redfin have a unified vision of a better way to buy and sell homes,” Varun Krishna, CEO of Rocket Companies, said in a statement. He added that this would involve linking up "traditionally disparate steps of the search and financing process" using technology.

Rocket said in the announcement that it envisions an all-in-one home buying experience, "from search to close, to servicing and future transactions."

That might look like a customer checking her phone to see what she can afford, booking a tour with a Redfin agent, and getting pre-qualified for a loan, "all in a matter of minutes," said Glenn Kelman, Redfin's CEO.

The joint announcement said artificial intelligence was also part of the reason for the deal. Through Redfin's existing platform, Rocket would gain data about homebuyers, sellers and agents — data that can boost the company's AI models that it claims will lead to more "personalized and automated" homebuying experiences.

Dan Gilbert's Rocket also said the deal could generate about $140 million in cost savings, including from duplicative operations. Other revenue advantages for Rocket would come from pairing its financing clients with Redfin real estate agents, and vice versa, as Redfin clients would be driven to Rocket's mortgage, title and servicing offerings.

A joint announcement said the deal has been approved by the boards of both companies and would close in the second or third quarter. The deal is subject to approval by Redfin shareholders.

Rocket's $12.50 per-share offer is about a 115% premium over Redfin's closing price on Friday. In early trading Monday, Redfin's shares were surging by more than 60%, while Rocket was down more than 13%.

©2025 www.detroitnews.com. Visit at detroitnews.com. Distributed by Tribune Content Agency, LLC.

Comments