Stellantis was born just over four years ago. It has cut tens of thousands of jobs since

Published in Business News

Stellantis NV employs about 50,000 fewer people worldwide than it did just over four years ago when the automaker came together with the merger of Fiat Chrysler Automobiles NV and French rival Groupe PSA, newly-released corporate filings show.

That 17% headcount reduction came as the automaker sought cost savings from the deal that created the world's fourth-largest automaker by volume, and as it continues to navigate the industry's expensive transition toward electric vehicles. The company ended 2024 with about 248,000 employees.

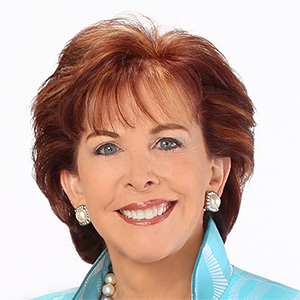

“Whenever you merge companies together, the first thing any CEO looks for is synergies,” said John McElroy, a longtime industry analyst and host of "Autoline After Hours." Such cuts often target duplicative finance, human resources, or legal departments, he added — but former CEO Carlos Tavares went "much deeper than that."

In North America, where layoffs and buyouts have been relentless in recent years, the headcount has dropped by about 20%, from 95,000 employees at the end of 2020, just after the merger was approved, to about 75,500 now, the reports filed with the U.S. Securities and Exchange Commission show.

The United States is where Stellantis continues to sell large numbers of its highly profitable Jeep SUVs and Ram pickups, but recently it hasn't kept pace with key competitors. Over the last two years, the carmaker's market share in the country tumbled nearly three percentage points, to 8%, its annual report shows. That sent Stellantis down two spots, to sixth place, in the U.S. automaker pecking order, falling behind Hyundai/Kia and Honda Motor Co. Ltd.

The North American cuts continued last year, as Stellantis slashed about 6,000 total workers amid slower sales, bloated dealer inventories and plant disruptions.

The company trimmed hundreds of jobs from its white-collar workforce in Auburn Hills, and carried out multiple rounds of U.S. factory layoffs that drew the ire of the United Auto Workers. United States employment currently stands at about 48,000, with about 37,700 of those union-represented workers, the company said.

The job reductions came as North American vehicle shipments of Stellantis vehicles fell 25% in 2024 compared to the prior year, and as adjusted operating income for the region plummeted 80%.

But Stellantis says it will hire about 1,000 employees in the United States this year. "The added jobs will be in key areas such as engineering and quality, keeping with the commitment to invest in the U.S. and bring to market exciting vehicles that customers demand," said a statement from spokeswoman Shawn Morgan.

Last year, the carmaker removed about 10,000 employees from its payroll worldwide as its net profits slid 70% year-over-year. Those headcount reductions include the December sale of Comau, Stellantis' industrial automation and robotics business based in Italy, and its 3,700 employees.

Two of the company's five business regions did add staff in 2024: the Middle East and Africa, and South America. Stellantis has said it sees potential for growth in those regions as part of its "third engine" beyond the main profit centers of North America and Europe, and it has also shifted some of its engineering work to those regions.

Under Tavares, Stellantis aggressively sought savings from the merger. He said at an investor event last year that the company had found about $9 billion in "synergies" since the deal came together, more than double initial expectations. Such aggressive cost-cutting would help the company's performance, and protect its position in the industry, he said.

The focus on finding savings was notably on North America, including in departments like engineering, said McElroy, with some roles cut and others shifted to lower-cost countries such as Morocco.

“I think the horrible mistake that Tavares made when it came to the North American operations was he focused laser-like on the cost, ignoring the fact that it was the greatest source of profits in the company," McElroy said.

Stellantis has struck a less aggressive tone on cost-cutting since Tavares left in early December. It has reupped investment plans for key plants in the United States and pledged to invest in its domestic workforce.

Chief Financial Officer Doug Ostermann noted on a recent call with investors that the company underwent significant restructuring, including job reductions last year — moves that had come with their own $1.7 billion ($1.6 billion euro) in costs — but that he didn't expect similar cuts in 2025.

"I don't see these large workforce reductions continuing going forward," Ostermann said. "We will, of course, continue to be frugal and efficient, but I think the size of the reductions will come down."

Stellantis Chairman John Elkann, who is leading the company as it searches for a new CEO, noted on the same earnings call that 2025 "is a year where we need to get back to profitable growth. We need to get back to more profits. We need to get back to generating free cash flow."

Stellantis' two Detroit rivals, who face many of the same industry headwinds, haven't carried out similar levels of job cuts in recent years. Ford Motor Co.'s global workforce of about 171,000 as of the end of last year is about 8% smaller than it was in 2020, but its U.S. workforce grew by about 3,000 workers in recent years to its current total of 87,000.

General Motors Co., meanwhile, added about 7,000 employees worldwide since 2020, bringing its total workforce at the end of 2024 to 162,000. In the United States, however, the automaker's employment levels have fluctuated up and down over the last five years, and currently stand at about 97,000, down from 104,000 in 2022. The automaker carried out several large layoffs in the last two years, including a 1,000-worker reduction in November that included hundreds from its tech center in Warren.

Stellantis workers in the United States faced several rounds of cuts last year — from engineering and tech employees to a steady culling of factory staff in the fall. One of the largest came in October when more than 1,000 workers were laid off from Warren Truck Assembly after production of the Ram 1500 Classic pickup ended.

That was among the layoffs that infuriated UAW leaders, who said jobs at Warren could have been saved if the company wasn't shifting more Ram pickup production to Mexico. The union had repeatedly called for Tavares' ouster in the months before the CEO left.

"Thousands of UAW Stellantis members are laid off due to the gross mismanagement we saw under former CEO Carlos Tavares," UAW President Shawn Fain said last Friday in a statement to The Detroit News. "With very active talks ongoing around tariffs, the new Stellantis corporate leadership has a golden opportunity to invest in American manufacturing and get UAW members back to work."

Fain called out the Warren layoff in particular — "the traditional home of the Ram pickup" — telling The News that the company should reverse its moves aimed at building more pickups in Mexico.

After Tavares' departure, Stellantis decided against cutting a shift at its Jeep Gladiator facility in Toledo and laying off as many as 1,100 people, cuts that were set to take effect in early January. That was a relief to UAW Local 12 President Bruce Baumhower, who had worried about ripple effects at local suppliers that could've resulted in hundreds of additional jobs lost.

Instead, more consistent recent sales of both Jeep Gladiators and Wranglers have allowed the plant to retain a normal employment level of just over 4,000 workers: "We're rocking and rolling," he said last week.

Stellantis executives have made other recent investment announcements and statements that suggest a shift in its aggressive cost-cutting approach — at least in the United States — following Tavares' departure, and as President Donald Trump took office and called for more U.S. manufacturing investment. That includes a plan to reopen the shuttered Belvidere Assembly Plant in Illinois, which will return about 1,500 union jobs, and investing in several other key facilities, including in Detroit and Toledo.

"We stand ready to build quality vehicles," the UAW's Fain said, "but we need to see real investment in our plants and communities to make that happen."

©2025 www.detroitnews.com. Visit at detroitnews.com. Distributed by Tribune Content Agency, LLC.

Comments