Jill On Money: The Fed gets what it wants

When it was released a month ago, the July jobs report sparked worries that the economy was careening towards a recession, which along with the unwinding of a big bet where traders borrowed cheap money from the Japanese government and reinvested it around the world to earn higher returns (aka "the carry trade"), caused a nasty sell-off in global stocks.

In the weeks following the July data, confidence improved, only to be upended on the first trading day after the long Labor Day weekend.

On that Tuesday, stocks sold off, which the breathless financial media attributed to weaker than expected manufacturing data and a warning from Goldman Sachs about slowing demand out of China. Or maybe, people returned to work after enjoying a summer break and realized that stocks were up by almost 20 percent on the year, which made them ripe for a little profit-taking.

We only had to wait a few days after the post-Labor Day stock drubbing to learn about whether or not a slowdown in the labor market persisted in August. The government reported that the economy added 142,000 jobs, slightly lower than the consensus estimate of 160,000 – and importantly, revisions to June and July (there are always revisions in the two subsequent months after the initial report) showed that there were 86,000 fewer jobs added than initially reported.

From June through August, the economy averaged 116,000 new jobs per month, down from the previous three-month average of 211,000. The unemployment rate ticked down from a two-year high of 4.3% to land at 4.2% and annual wages were up by 3.8%, ahead of the inflation rate of just under 3%.

There was also separate evidence that the job market was softer than we thought. The Bureau of Labor Statistics (BLS) released its first estimate of its annual revision to job market data. (As a note, each year, the government refines its numbers for the 12-months through March. The final revision will be announced in February 2025.) The BLS found that there were 818,000 fewer jobs from March 2023 through March 2024, with professional and business services and leisure and hospitality jobs accounting for more than 60% of the discrepancy.

Of course, this labor market slowdown is exactly what the Federal Reserve wants to occur. When the economy cools, so too do price increases. Just check out the tumbling crude oil market, which has pushed down gas prices by 50 cents from a year ago, not to mention wheat prices, which touched 2024 lows, for proof.

With the inflation rate receding, the Fed must now focus on its other big job, which is making sure that the labor market remains in balance. In his speech at Jackson Hole last month, Fed Chair Jerome Powell said that “the labor market has cooled considerably from its formerly overheated state,” as the economy has seen “a substantial increase in the supply of workers and a slowdown from the previously frantic pace of hiring.”

The central bank will begin its rate cutting part of the cycle on September 18, though as always, officials hedge their bets with the caveat that “the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

To allay the fears of those who think that the Fed might be too late in its rate cuts, putting the soft economic landing at risk, Powell was crystal clear: “We will do everything we can to support a strong labor market as we make further progress toward price stability.”

Translation: We will act fast and furiously to slash rates if the labor market rolls over.

_____

_____

========

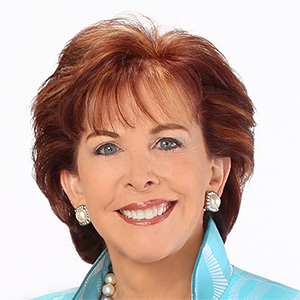

(Jill Schlesinger, CFP, is a CBS News business analyst. A former options trader and CIO of an investment advisory firm, she welcomes comments and questions at askjill@jillonmoney.com. Check her website at www.jillonmoney.com)

©2024 Tribune Content Agency, LLC

Comments