Business

/ArcaMax

It's time to take required distributions

Required minimum distributions (RMDs) loom for millions of seniors who have reached age 73. These distributions from retirement plans, such as IRAs, 401(k)s and 403(b)s, must be completed by year end. Avoid the holiday rush, and contact your retirement plan custodian now.

The rules are simple, but the penalties for failure to withdraw on time ...Read more

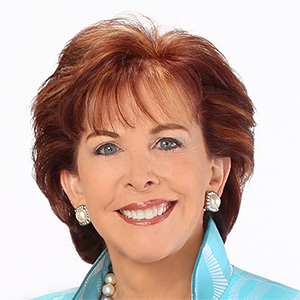

Terry Savage: Sorting out Medicare Part D drug coverage

Medicare’s drug coverage has been dramatically changed for 2025. Figuring out what you should do is one of the most complex challenges you will face in the next few weeks. Only one thing is for sure: Everything has changed, so you MUST do something — even if you loved your 2024 drug coverage.

Whether you have a stand-alone Part D drug plan ...Read more

VA mortgage loans are a great deal

In an election year it’s all too easy to forget that Veteran’s Day is November 11, even though all federal offices and banks will be closed. The holiday was made official in 1954, having previously been celebrated as Armistice Day to mark the end of the First World War.

Our financial system has not forgotten those who served in our armed ...Read more

Terry Savage: Big changes to Medicare demand attention during open enrollment

It’s time for Medicare open enrollment, the few weeks between October 15 and December 7 when all current Medicare beneficiaries must make some important decisions about their coverage for 2025.

Even if you were perfectly content with your coverage this year, some big changes are coming that could be costly if you fail to take action. Here are...Read more

Terry Savage: This year's best retirement book

Every year a new book comes along that is truly worth taking the time to read — and more than once. This year’s outstanding book is the just-published “How to Retire: 20 Lessons for A Happy, Successful and Wealthy Retirement” by Morningstar’s director of personal finance, Christine Benz.

While most of us view the words “retirement ...Read more

Terry Savage: Choosing value in college selection

There is no doubt that a college education is a key ingredient in future success — although these days it’s harder to find a skilled plumber or electrician than a liberal arts grad driving an Uber.

The cost — and value — of an education over the long run is something parents should start thinking about when their children are in high ...Read more

Terry Savage: Understanding the interest rate market

We measure the stock market performance by popular indexes such as the Dow Jones Industrial Average or the S&P 500, both of which have made a series of new highs this year. Yet there are plenty of stocks that are lagging behind. In other words, what we call the "stock market" is not a monolith but rather a “market of stocks.”

And the same ...Read more

Is your home your piggy bank?

Despite the soaring value of the stock market, residential homes are considered the largest asset class in the country. The United States’ residential real estate market is worth $43.5 trillion, which is larger than the market capitalization of the S&P 500 stock index and the total value of all U.S. public companies.

The housing market ...Read more

Credit problems are rising

Credit card debt is soaring, interest rates on balances have moved into the 30% range on many cards, and delinquencies and bankruptcies are rising. The statistics are grim as consumers fight to keep up with higher prices, having spent down their pandemic-era savings.

According to data released by the Federal Reserve, credit card balances ...Read more

Alone and older

This column was prompted by a call to a radio program from a man who explained that he is fairly well situated financially as he enters retirement, but he was worried about the fact that he has no children, no close family and no trusted friends to rely upon as he grows older.

It’s a problem that has suddenly risen to the American ...Read more

The Fed, money and markets

The Fed has spoken. Chairman Jay Powell clearly declared victory over inflation at his annual Jackson Hole, Wyoming, press conference. The next direction for interest rates is down. The Fed appears to have done the impossible: reduced inflationary expectations without causing a steep recession and loss of jobs.

While inflation is not yet down ...Read more

REAL financial planning

Caution: Read this column only if the idea of “running out of money” in your lifetime (with the exception of Social Security) keeps you awake at night! Relying on conventional financial planning could give you a 20 percent likelihood of that result.

In my columns I try to recognize the diversity of my readers. The one thing they have in ...Read more