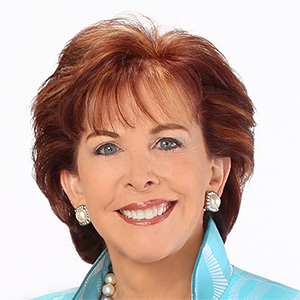

Terry Savage: Tax benefits can amplify your charitable giving

Giving to charity is all about money — and if a tax benefit comes along, the gift is much sweeter. But since the tax reforms of 2017 increased the standard deduction, 9 out of 10 Americans don’t itemize their tax returns — and thus don’t get a deduction for their contributions.

Still Giving USA notes that in 2023, Americans gave $557 billion — more than half a trillion dollars — to charities. And for those organizations, the money they receive makes all the difference in their ability to help the less fortunate, find a cure for diseases, save animals from pain and suffering, and make up for budget cuts from the government.

No matter how much or how little you give, or whether you get a tax deduction for your gift, it makes sense to give with a purpose and a plan. Here are some tips.

Don’t fall for those late night TV pitches, fancy mailers or cold calls tugging at your heart. Actually, many of these charities that spend the most on marketing use the proceeds for administrative costs and salaries, with a lesser amount going to the actual cause.

Start your giving at CharityNavigator.org, where you can research the ratings of how well the charity puts your gift to work. Each charity must file an IRS Form 990 every year, detailing its income, expenses and complete financial statement. The CharityNavigator ratings give you a way to compare good causes.

But if you aren’t searching for a specific charity, you can use the site to give you ideas for groups that help a cause close to your heart. A search for “Alzheimer’s research” or “no-kill animal shelters” could lead you to a place that definitely puts your money to work in a way that makes you feel good.

You don’t have to be wealthy to consider the tax implications of your giving. The deductible limits are enormous; you can give up to 60% of your adjusted gross income in any one year, or 30% if your gift is “in kind” — a property with a documented current value.

Wealthy people donate highly appreciated stock so they don’t have to pay capital gains taxes. They get a full deduction for the current value, up to those income limits.

But here are two paths to charitable giving that can create tax benefits, even for the average income donor.

Charitable distribution from an IRA: Every year you can make charitable distributions directly from your IRA — and even count it toward your RMD, up to $100,000. That means you don’t pay ordinary income taxes on a withdrawal, and then file for a tax deduction. But the gift must be made directly from the IRA custodian to a recognized 501(c)3 charity — and it must be made before year-end, so start the process now!

Donor advised funds: You don’t have to be wealthy to create your own “foundation”! Donor advised fund accounts can be set up at most major financial institutions, including Fidelity and Vanguard.

The idea is to make a larger, one-time donation to this account — enough to earn you a tax deduction in the current year. You can even donate appreciated stock to this account, avoiding gains taxes. Then the money stays in the account to grow inside in tax-deferred investments, building the assets inside your “foundation” just like the Rockefellers!

Each year you must distribute a small portion of the account value directly to recognized charities, directly from your donor advised fund account. You don’t have to be wealthy to open this account; Fidelity has no minimum, and says gifts to charities must only be at least $50. But last year, Fidelity reports it distributed $11.8 billion in donations out of its charitable gift fund.

This is a great way to get the younger generation involved in making charitable contributions — a perfect research project for kids to direct giving to good causes. There is even a donor advised fund connected with an app — Daffy — that allows you to set up an account and instantly direct contributions to qualified causes.

So here we are in the season of giving. The stock market is at record levels, yet many are struggling just to keep up with inflation. If you’ve received the benefits of your good financial planning, there is one more gift you can give yourself: The good feeling that comes from giving to a worthy cause.

And that’s The Savage Truth.

========

(Terry Savage is a registered investment adviser and the author of four best-selling books, including “The Savage Truth on Money.” Terry responds to questions on her blog at TerrySavage.com.)

©2024 Terry Savage. Distributed by Tribune Content Agency, LLC.

Comments